Feckonomics

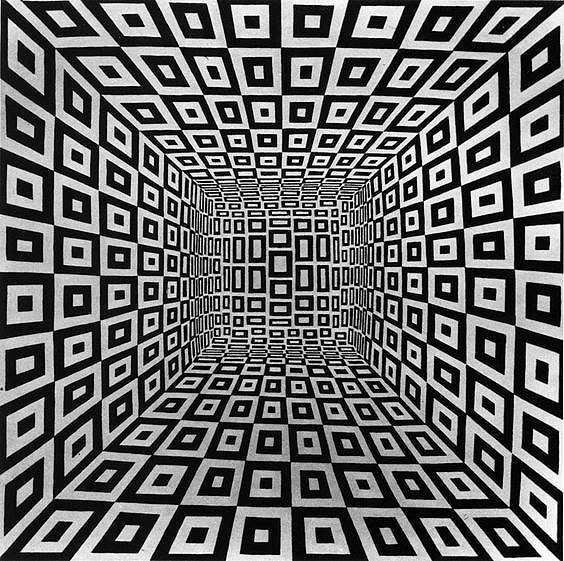

Richard Anuszkiewicz, Knowledge and Disappearance, 1961

"Human agency becomes evidence of absent fealty and simple want, a grave moral shortcoming."

Economics seems the most feckless profession, one largely populated with avowed blind men endlessly arguing over the nature of an imaginary elephant before them. Each wears the spectacles acquired through their religious conversion into one school or another, the sorts of schools more focused upon indoctrination than studied observation. One might claim to be of the Austrian School, an aristocratic pedigree, indeed. Another might have sworn fealty to Keynes, a mighty systems thinker who never actually settled into any particular insistence. The Behaviorists have become increasingly popular, though they fancy themselves as insurgents not aspiring to prominence within the profession. Supply-siders, rarer than exotic hen's teeth following their 2008 financial system debacle, executed a come back on the backs of whacky, self-espousing conservative Christian law breakers, only to systematically organize another feckless pilfering of the public purse for parochial allocation. It seems that only the depth and color of conviction separates these schools, each in turn becoming the favored idiot step-child of some ignorant administration. ©2020 by David A. Schmaltz - all rights reserved

However wise and well-informed any individual economist might have proven him/herself to be, their philosophy only ever finds utility when associated with some administration's policies, and those policies are largely framed by folks with much less understanding and perhaps even greater religious conviction than any individual practitioner. The chief administrator, even and perhaps especially when said administrator can't seem to administer anything, picks and choose from among the policy options garnered from the various schools, whereupon they implement said Spumoni policy as if it actually represented the pure result of reasoned consideration rather than merely blended religious conviction. Anything might thus become justified and broadly advertised as the next sure bet perfect thing for whatever ails the broader population. Recently, we've seen a surging popularity in tax cuts, touted as the sure cure for everything from piles to poverty, though they have historically seemed to reliably perform a number on general prosperity. We have grown beyond feeling surprised when we see a few of the more feckless fade into obscurity with the cash while everyone else stumbles around looking for the bag they'd understood would hold their share. The latest tax cut increased my taxes, highlighting my ecumenical ignorance, I suppose. If you don't sincerely believe, you won't, apparently, receive.

Decades of increasingly disappointing results hardly threatened the popular conviction that an economy simply had to maintain a gold standard supporting it. Entire populations were cruelly driven into big 'D' Depression and big 'R' Ruin before the orthodoxy even began considering that their Jesus might have gotten wrong the foundation of their very religion, then another struggling few decades passed before a fresh, widely supported gold standard-less orthodoxy came along. The most trustworthy economists seem to be the least believable, since they continually change their perspectives. This common paradox leaves those most observant at a sincere disadvantage when compared to the most religiously espousing, since those with fixed positions seem most convinced of their own correctness. Those who have grown into an understanding that they're evaluating a constantly shifting target seem to change their minds an awful lot, and thereby might appear less competent.

An executive friend recounted how one of his fellow executives complained that he seemed to have been arguing a precisely opposite position in this meeting than he had in the last one. He explained that he had learned something between the two meetings. Learning something seems the sole unforgivable sin in the Feckonomist's profession, since each fresh insight faces the collective might of steadfastly reinforced religious conviction opposing its recognition. Should a politician find that insight attractive, not necessarily on its merits but on its propaganda potential, it might quickly short-list into some fresh orthodoxy, otherwise it might more likely tickle readers of the OpEd page before sliding back into utter obscurity. Nobody's likely to ever simply hand over managing any economy to any competent professional, however insightful they might seem. Mostly, I suppose, we should be grateful for the entirely mythical Invisible Hand, who apparently handles the helm while professors and politicians perform their feckless dance.

In any complex system, right and wrong lose essential distinction. Impressions rule more than any actual rules might. Nobody seems capable of staying any course because the territory remains tenaciously indistinct and continually shifting. One makes guesses and assesses results, understanding that every sample size seems far too small to properly represent the apparent dilemma. The ship of state navigates by astrology, a satisfying state for those properly conditioned to the lore and mystifying to anyone expecting any rational resulting course. Convictions come and go like the performers in a Vaudeville show, and plots thicken and thin, seemingly at the whim of some disinterested God. When the economic conversation turns to morals—Moral Hazards and such—you can reliably expect a fresh raft of absolute bullshit to shortly start raining down upon the proceedings. People will find themselves forced into depravation in the interests of broader moral public considerations. Not having a job becomes evidence of grave moral shortcomings, and those with billions insist upon the necessity of maintaining faith in an orthodoxy promising to deliver in an unforeseeably distant future. Heaven awaits only those willing to wait. Human agency becomes evidence of absent fealty and simple want, a grave moral shortcoming.