Deficits

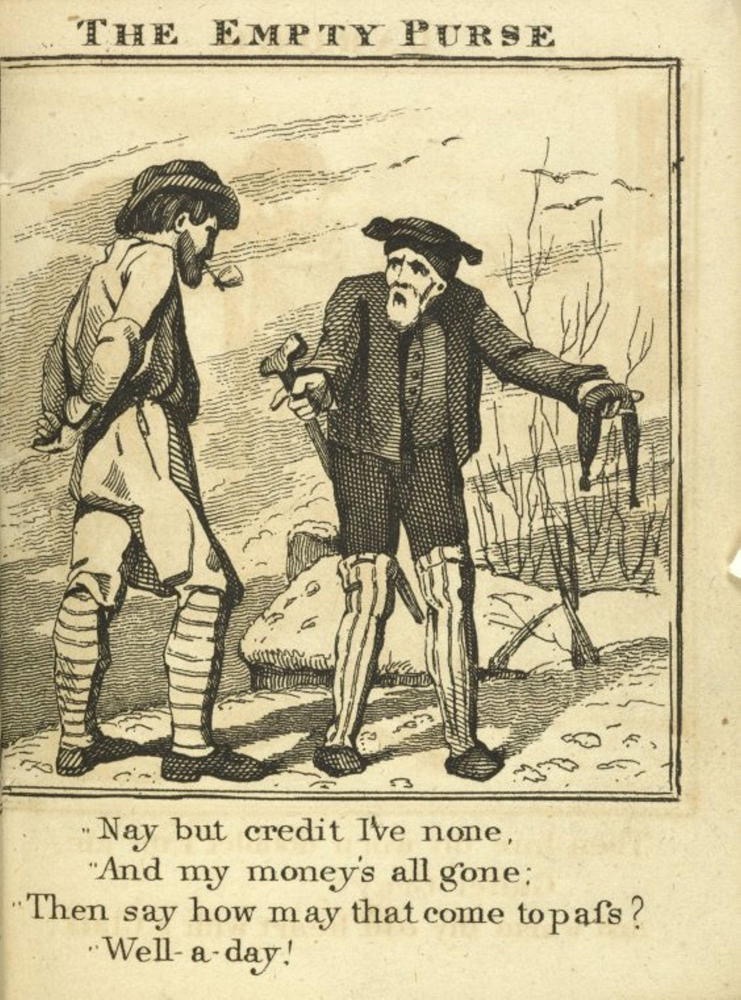

Thomas Holcroft: The empty purse (1806)

"Damn those who never learned how to manage money!"

The key might be to balance. The very wealthy are different from the rest of us because they exclusively live on somebody else's money. It amounts to a wise way to live if you can get away with it. The more complicated way to live must be hand to mouth, or hand to forehead when there's not enough. Those who live by exchanging cash or, heaven forbid, gold, forfeit the possibility of leverage, a magical process by which one can comfortably live beyond one's means. Galbreath said that every generation seems to need to relearn the lessons leverage extends. They usually learn by leveraging too far beyond even their magically-extended means to utterly undermine their dreams. They default on their debt and undermine their credit. This catastrophic event instantly evaporates prosperity, sometimes permanently leaving the debtor in penury.

But I speak here of individuals and corporations, not reserve currency nations. The rules for those who make the rules remain steadfastly different from the ones by which every other country must abide. As long as the world perceives that reserve currency as trustworthy, it need not necessarily be backed by anything much more substantial than that trust. It remains acceptable as long its users see that reserve currency's management as reasonable. Reserve currencies have traditionally enjoyed a much more lax standard for what constitutes reasonable. It lies somewhere between one hundred percent backed by hard gold reserves and primarily supported by a diminishing bond market with once-robust demand. The size of any reasonable Deficits remain relative to a thousand factors and in no way relates to what any individual or corporation might presume to be tolerable for themselves. I can't say that the reserve currency's owner's Deficits don't matter, but they matter materially differently. As long as their underlying economy continues growing without inducing too much inflation, and as long as their trading partners remain reasonably free to openly trade, they are in a strong position to spend almost whatever they want and use everybody else's money doing it.

On January 20, 2025, the United States of America suddenly and without warning manifested a ruinous Deficit. Well, no, they actually didn't, but that was the cry that came up from a guy who'd never spent a cent of his own money on any investment but still managed, several times, to lose more than his original personal stake through over-leveraging. If there were one person in the history of this still-great nation whose financial advice we should ignore, it would be this person. Anyway, he began insisting that our Deficits were threatening our way of living rather than adequately supporting it. He prescribed what no other billionaire would ever suggest for their portfolio: that we resolve the suddenly evil Deficits and "live within our means." We had been living well within our means because that means we maintained eminently manageable Deficits. In about a second, we went from undoubtedly the wealthiest nation in the history of the world to one that couldn't even afford to pay our kindergarten teachers. Mass layoffs ensued as if there were other ways for those fired to make a living and as if our economy didn't need their services. We went from the wealthiest to a second-rate third-world nation in about thirty seconds.

The Repuglicans had been actively reframing prosperity to mean penury for forty years. It seemed like the most practical way to engineer an enormous swindle that would redefine income equality into a fundamentally American principle. The swindle was remarkably simple. One just needed to compare our nation's budget to a citizen's checkbook. Extending that allegory into Deficit territory created a story that could terrify almost anybody. What if we defaulted on the good faith and credit of the United States? What if we became one of those debtor nations that communism effortlessly overthrows? We'd best avoid any semblance of socialism because that is where the slippery slope begins. Charity inevitably begets communism. They insisted that it had never been the purpose of our government to see to the welfare of its citizenry to encourage its economy. They sought to dismantle the prosperous society so they could plunder the treasury. They pretty much succeeded.

Except for that pesky fact that our nation's finances do not operate like that. We remained, until just after noon EST on January 20, 2025, wealthy enough to permanently eliminate poverty worldwide if we so chose. We were wealthy enough to effectively eliminate want and replace it, if not with plenty, then with enough. The billionaire class has never imagined acquiring enough, a modest objective for those of us never bedazzled by excess. Those who try to be the last person to board the flight and hope the only remaining seat is in the back row that doesn't recline and next to a fussy baby maintain a different threshold for achieving personal satisfaction. I would that we could adopt such standards for our nation. Our Deficits were fine until that cold early January afternoon. Our new incumbent was merely ushering in a Mr. Potter's NextWorld, where decency seemed destined to shrink a bit faster than our newly-reviled Deficits. Damn those who never learned how to manage money!

©2025 by David A. Schmaltz - all rights reserved