Deflating

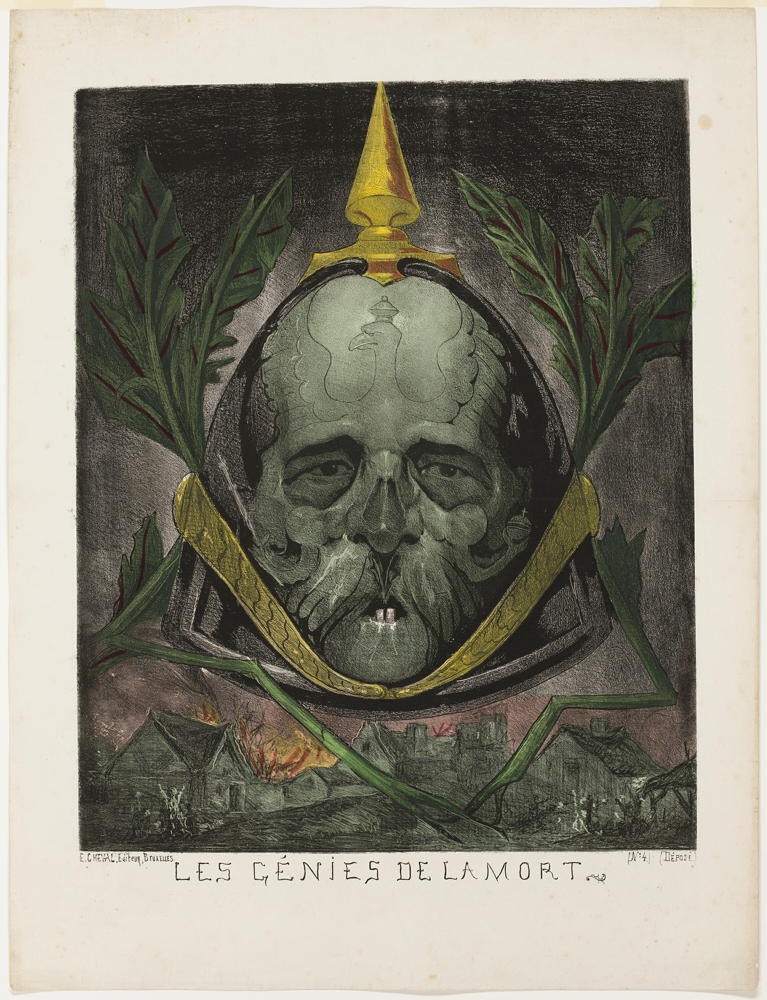

Edmond Guilliaume: Bismarck, from Les Génies de la Mort

[The Geniuses of Death] (1870)

ABOUT THIS ARTWORK

Edmond Guilliaume’s images are blunt caricatures that combine well-known German symbols, war leaders, and macabre images of destruction. Otto von Bismarck became prime minister of the Prussian state in 1862 and of the unified German Empire in 1871. To a French audience, he was the cruel leader of the Franco- Prussian War (1870–71). With a skull head, pointed Prussian helmet, and Prussian eagle superimposed on his face, Bismarck looms like a poisonous, grasping plant over the destruction of the French countryside. Playing off a noble coat of arms, Guilliaume gave the French enemy a ghoulish image of death.

"We'll see who fills the gaps deliberately carved into our once-reliable safety nets."

When I attended high school, my part-time after-school job paid me $23.50 in today's currency per hour. Further, depending on the season, anyone who wanted a job could find one. Through the summer, even better-paying harvest work went begging. My actual rate of pay was $2.50. The Vietnam War raged in the background, and the economy was booming. As the war started winding down, inflation became a concern. Unemployment became a thing again as the economy cooled. Several shocks to the economy occurred in the early seventies. War in the Middle East spawned a slowdown in petroleum imports, which raised domestic gas prices by over fifty cents a gallon, doubling overnight. Interest rates soared as never before, with mortgage rates climbing into the mid-teens by the end of that decade. The Reagan Administration engaged in almost unprecedented efforts to reign in what was labeled "stagflation," economic stagnation combined with alarming inflation. The effort attempted to cool the price expansion without cratering economic growth. This was my introduction to Deflating.

For most of my life, the economy had hummed along growing. Prices steadily increased but at a modest rate. Some assets grew much faster than others, with real estate often touted as a sure-fire investment. The stock market produced a reliable seven percent return on average, which doubled its value about every seven years. Reagan's Deflating efforts disrupted this predictable cycle. Real estate prices tumbled. Bonds became more valued than stocks. Growth, once presumed, receded. I'd purchased my first home by then but found I was underwater from the moment I signed the mortgage. I'd assumed that interest rates would likely slip back down into their historically normal range, but they didn't. The idea that I might leverage that place with a second mortgage to pay for improvements couldn't float. I entered an unleveraged cash economy. Deflating infected every aspect of my life. I don't doubt it was a contributing factor to my first divorce after a decade of serial inability to improve our lot in life. It was exhausting being so damned discouraged all the time.

Inflation seemed to me to be primarily a positive psychological phenomenon. The sense that the universe continues expanding produces a generally positive outlook. Even if the increase appears on paper without any consequent increase in absolute value, watching your piece of pie expanding is genuinely uplifting. In high school, I had no idea I was making three times what would be the declared Federal minimum wage sixty years later. I knew I made plenty to keep me in clothes and pay for gas in my mom's Volkswagen when I drove it. I never wanted to own a car, but I could have afforded one working part-time. I remember those years as good times. The following decades were not nearly as kind. The real estate market was flat or falling through the eighties. We finally managed to trade up into a better house, but we lost twenty-five percent of the purchase price and even more when I consider I'd serviced a fifteen percent mortgage over those years.

Our NextWorld will feature financial distruption on scales few living will have ever experienced. In 1929, the US economy experienced rapid Deflating caused by the stock market crash. There was no quantitative easing encouraged by the Fed. Then, the government's first response was to avoid responding, so great was Hoover's faith in the markets self-mending. The result allowed Roosevelt to handily win the presidency by promising a chicken in every pot. The Jazz Age was booming a decade before, and nobody cared a whit for chicken. They were enjoying a filet mignon economy. The latest economic forecasts suggest our economy will shift from near four percent growth last year to a negative four percent this. That eight percent reduction will certainly not be coming off the top, for economies deflate from the bottom up, with the upper echelons rarely contributing a cent to the kitty. Those who own real wealth, the Scrooge McDucks with swimming pools filled with specie, float far above the poor devils suddenly struggling to afford their mortgage payments on radically reduced income. Worse for the suddenly unemployed federal employees released into a shriveling economy offering no equivalent jobs.

It was the Reagan Republican vision that our federal government might be shrunk to the size that it might be drowned in a bathtub. This was always a perverse vision, for no future was ever likely to thrive without a vibrant federal bureaucracy at play. The value of all those "over-priced" government services was always the difference between barely getting by and thriving. Yes, the conservatives would always complain about the high cost of everything without slowing down to consider the value the government was producing. The peace of mind that comes with an economy humming along reliably inflating at about seven percent per annum must be worth something. The experience of not worrying where the next meal might be coming from is worth much more than the cost of any mere meal. The necessity of maintaining a certain standard of living, even one guaranteed when necessary, far exceeds the inconvenience of any modest tax. Back in my good old days, there were fewer millionaires, and I suspect that billionaires were essentially non-existent. Their emergence brought nothing for most of us. We'll see who fills the gaps deliberately carved into our once-reliable safety nets.

©2025 by David A. Schmaltz - all rights reserved